If you’re estate planning for yourself or a loved one, don’t make these mistakes! Certified Elder Care attorney Barbara McGinnis said these are the five biggest no-no’s she sees her clients make. If you’ve made one of these mistakes, don’t worry! It’s not too late to make it right. We’ll tell you what you need to know to avoid these pitfalls.

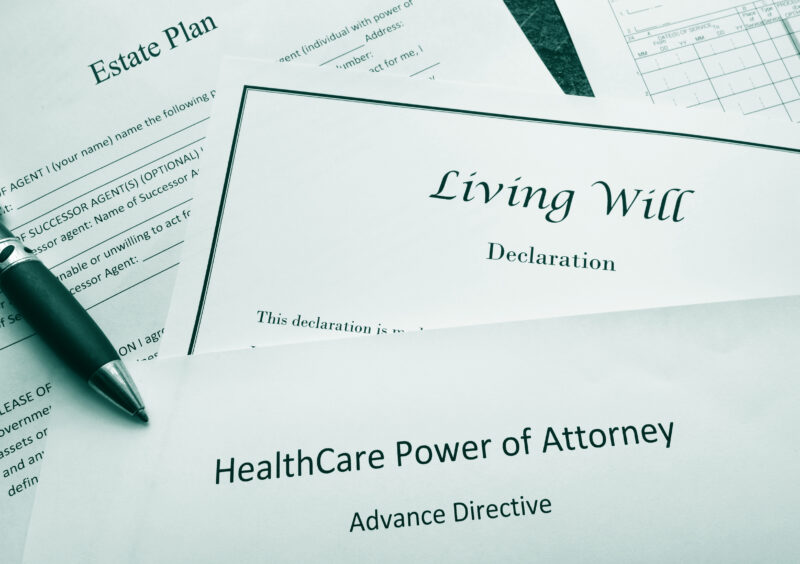

Mistake #1: A will is not your most important document

Yes, you need a will, but your needs don’t stop there.

“A will is an important document, but it’s not your most important document,” McGinnis said. “A will becomes effective after your death and when it’s administered to the probate court. A will will not help you avoid probate. It’s designed to go to the probate court and it’s only effective at death. That’s why I say it may not be your most important estate document, but sometimes you need help while you’re still alive.”

Mistake #2: A will is not a “one and done” event

Just as your life changes and your needs evolve as you age, so too should your estate plan. “That’s a very common mistake,” McGinnis said. “It probably entirely met your goals and your purpose when you planned, but because life changes for all of us, estate plans can become stale. It needs to be updated for certain things: deaths, divorces, births, all kinds of difficult events.”

Even new diagnoses for yourself or your spouse can and should impact your estate plan and how you want assets passed along. Even if you have none of those major life events, you still want to have a check-in every 10 years to make sure there haven’t been tax law or estate law changes that could impact your plan.

Mistake #3: Not planning for disability prior to death

“About 70% of the time, if not more, people experience a period of disability prior to death,” McGinnis said. “You can experience frailty, disability, perhaps even incapacity or incompetence before they die, and we have to plan for that. How we plan for that is through effective and thorough powers of attorney.”

Your loved one can have a durable general power of attorney and a health care power of attorney. Both spell out the authority given to someone they trust, who becomes a fiduciary or an agent. The older adult can also outline in the documents what they want another person to manage and the scope of their needs.

The other thing you may want to consider for your loved one is a living trust. This may be revocable or irrevocable, and can be used to help during a period of incapacity. Trusts are a way to manage assets, protect assets and pass them on without the probate process.

Mistake #4: Giving away assets prematurely

“Sometimes people think that giving away their assets to their children is a way to protect their assets from future creditors,” McGinnis said. “All they’re really doing is spreading out the risk pool. If I’ve given away my house or sizable funds to my children, I’ve just increased my risk pool. We’re all now subject to the risk of sudden death, disability, bankruptcy, divorce.”

Instead, your loved one should consider using a trust to pass those assets along. This allows for the assets to transfer with creditor protection. It also allows for changes if they change their mind about distributing those assets.

Mistake #5: Procrastinating!

“What we hear is, ‘I just haven’t had time, it’s not the right time,'” McGinnis said. “But what you’re really saying is that you’re deciding not to decide. People that procrastinate or decide not to put a plan together, they can have unfavorable outcomes and leave a mess for their families to pick up. If you truly love someone and you want to protect your family, protect your family and stay in control by putting together a plan.”

You can find several tools online to help you put together an estate plan; we have reviewed several in our analysis here (both paid and unpaid options).

If you’re in Tennessee and interested in meeting with Barbara McGinnis and her team at Takacs McGinnis, reach out to her directly here. If you’re outside Tennessee, the National Academy of Elder Law Attorneys has a directory of attorneys near you.